Wallbridge Launches 2026 Exploration and Technical Studies Programs

TORONTO, Feb. 17, 2026 (GLOBE NEWSWIRE) -- Wallbridge Mining Company Limited (TSX: WM, OTCQB:WLBMF) (“Wallbridge” or the “Company”) is pleased to announce the initiation of its fully funded 2026 exploration and technical studies programs, highlighted by the commencement of drilling at its 100%-owned Fenelon Gold Project (“Fenelon”) in northwestern Québec.

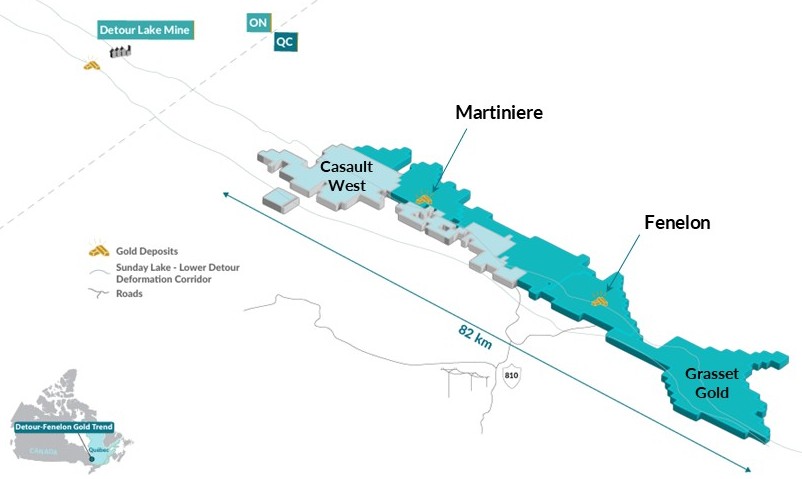

The 2026 program represents one of the Company’s more active exploration seasons in recent years, with approximately 25,000 metres of drilling planned across the Fenelon, Martiniere, Casault and Grasset properties. The program is designed to advance Fenelon toward its next stage of technical development while continuing to unlock growth potential at the Martiniere Gold Project (“Martiniere”) and earlier stage prospects along the Company’s 598 km² land position covering 82 kilometres of the prolific Detour–Fenelon gold trend.

“We are excited to have launched our fully funded, clearly defined 2026 exploration and development strategy. At Fenelon, our focus is on advancing the technical work required to further de-risk the project and position it for the next stage of development. At the same time we are allocating capital to systematically evaluate the broader growth potential at Martiniere and across our regional property portfolio,” commented Brian W. Penny, Wallbridge’s Chief Executive Officer.

“Our 2026 program is structured to balance longer term development priorities with nearer-term resource growth opportunities, while maintaining financial discipline and flexibility as results are received,” concluded Mr. Penny.

2026 EXPLORATION PROGRAM OVERVIEW

Fenelon

Drilling has commenced at Fenelon with one rig focused on targeted infill areas within the current mineral resource that forms part of the conceptual mine plan outlined in the Company’s March 27, 2025 Preliminary Economic Assessment (“PEA”). This initial campaign will include approximately 2,000 metres of large-diameter (HQ) core drilling to support metallurgical test work and related technical studies. The program is designed to further evaluate gold recoveries across the deposit and characterize residual tailings and waste rock material to further de-risk the project as Wallbridge advances Fenelon along the development pathway to a future pre-feasibility study.

The Company has engaged Synectiq, an independent mining consultancy headquartered in Longueuil, Québec, to oversee and coordinate the metallurgical testing and related technical studies included in the 2026 program. Synectiq brings extensive experience managing multidisciplinary engineering and development studies for mining projects and has supported the advancement of projects from PEA through pre-feasibility and final feasibility stages.

Following completion of this campaign, a 1,500-metre reconnaissance drilling program is planned to test prospective targets located within approximately 2.5 kilometres of the main deposit area, in alignment the Company’s strategy of evaluating both near-deposit growth and regional upside.

Martiniere

In mid-March, a second drill rig will be mobilized to Martiniere where approximately 17,000 metres of drilling are planned in two phases. Phase 1 (mid-March to mid-May) will build on strong results from the 2025 exploration program and focus on expanding and evaluating the scale and continuity of the gold system. Phase 2 (early July to mid-September) will be designed based on Phase 1 results, positioning Martiniere for potential future resource delineation as results warrant.

Casault and Grasset

Upon completion of the initial Fenelon campaign, drilling will move to the Casault property, where approximately 3,000 metres of reconnaissance drilling will test priority targets including the Vortex prospect and several untested structural intersections along the Sunday Lake Deformation Zone (“SLDZ”). The SLDZ is a key structural corridor along the Detour–Fenelon trend, which hosts Agnico Eagle’s Detour Lake gold mine as well as Wallbridge’s Fenelon and Martiniere projects. Wallbridge holds an option to earn a 50% interest in Casault through its agreement with Midland Exploration.

Following completion of Martiniere Phase 2, approximately 1,500 metres of reconnaissance drilling are planned at the Grasset property to test newly identified targets along the eastern projection of the SLDZ.

The 2026 program will utilize two diamond drill core rigs from mid-February to mid-May, scaling down to one diamond drill rig from mid-May until the program’s expected completion in late September.

Total expenditures for 2026, including corporate G&A, are anticipated to be approximately $27 million. This total includes a 30% increase in exploration and technical studies program costs compared to 2025. The Company ended 2025 with a cash balance of $28.9 million.

Figure 1: Wallbridge Property Map Click to enlarge.

Qualified Person

The Qualified Person responsible for the technical content of this news release is Mr. Mark A. Petersen M.Sc., P.Geo. (OGQ AS-10796; PGO 3069), Senior Exploration Consultant for Wallbridge.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects in Quebec’s Abitibi region while respecting the environment and communities where it operates. The Company holds a contiguous mineral property position totaling 598 square kilometres that extends approximately 82 kilometres along the Detour-Fenelon gold trend. The land position is host to the Company’s flagship PEA stage Fenelon Gold Project, and its earlier exploration stage Martiniere Gold Project, as well as numerous greenfield gold projects.

For further information please visit the Company’s website at https://wallbridgemining.com/ or contact:

| Wallbridge Mining Company Limited | |

| Brian Penny, CPA, CMA Chief Executive Officer Email: bpenny@wallbridgemining.com M: +1 416 716 8346 |

Tania Barreto, CPIR Director, Investor Relations Email: tbarreto@wallbridgemining.com M: +1 416 289 3012 |

Cautionary Note Regarding Forward-Looking Information

The information in this document may contain forward-looking statements or information (collectively, “FLI”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections and interpretations as at the date of this document.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include, but are not limited to, words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI in this document may include, but is not limited to: the continuity of and expansion potential of the Fenelon and Martiniere gold systems; the potential for mine development at Fenelon; the potential to increase mineral resources on the Company’s properties on the Detour-Fenelon gold trend ; the growth potential of Casault, Grasset and the Company’s mineral properties in general; the amount of budgeted total expenditures during 2026; and the significance of historic exploration activities and results.

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this document is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained in this document to reflect new events or circumstances. Unless otherwise noted, this document has been prepared based on information available as of the date of this document. Accordingly, you should not place undue reliance on the FLI, or information contained herein.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Assumptions upon which FLI is based, without limitation, include: the results of exploration activities, the Company’s financial position and general economic conditions; the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Company’s mineral properties; the accuracy of key assumptions, parameters or methods used to estimate the mineral resource estimates and in the preliminary economic assessment; the ability of the Company to obtain required approvals; geological, mining and exploration technical problems; failure of equipment or processes to operate as anticipated; the evolution of the global economic climate; metal prices; foreign exchange rates; environmental expectations; community and non-governmental actions; and, the Company’s ability to secure required funding. Risks and uncertainties about Wallbridge's business are discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedarplus.ca.

Cautionary Notes to United States Investors

Wallbridge prepares its disclosure in accordance with NI 43-101 which differs from the requirements of the U.S. Securities and Exchange Commission (the "SEC"). Terms relating to mineral properties, mineralization and estimates of mineral reserves and mineral resources and economic studies used herein are defined in accordance with NI 43-101 under the guidelines set out in CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the Canadian Institute of Mining, Metallurgy and Petroleum Council on May 19, 2014, as amended. NI 43-101 differs significantly from the disclosure requirements of the SEC generally applicable to US companies. As such, the information presented herein concerning mineral properties, mineralization and estimates of mineral reserves and mineral resources may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/329c523e-afae-4472-a097-17f2c05b6b00

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.